The climate for consumer lending just got a boost. On September 19, 2024, The Federal Reserve slashed its benchmark interest rate by half a percentage point—the first, and the biggest, cut since March 2020 when COVID-19 adversely affected borrowers and disrupted the economy. This most recent cut amounts to a declaration of victory over inflation, which has come down from a peak of 9.1% in June 2022.

But what does it mean for marketing teams at retail banks and other lenders as they seek to increase new loans and refinancing?

The Fed’s move lowers interest rates to stimulate economic growth and lowers financing costs, signaling opportunities for banks and lenders as consumer purchasing, borrowing, and investing increase. And, as with any financial event, we can learn from historical experience—even when that history is nuanced, such as consumer behavior during a global pandemic.

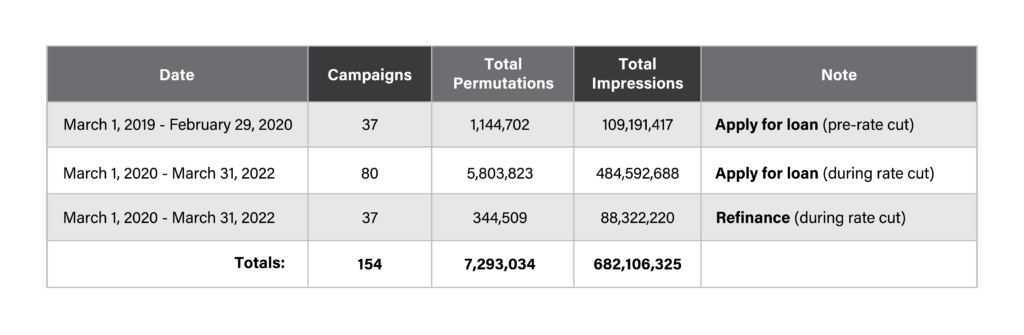

The Persado Content Intelligence team analyzed the top emotions that motivated consumers before vs. during the pandemic to inform content best practices for marketers during this new era of rate cuts. I say “cuts,” because the September 19, 2024 cut may be followed by additional cuts this year (J.P.Morgan Wealth Management).

We considered how content performs for new loans, as well as refinancing existing loans. Here are our findings: the highest-performing (clicks or conversions) emotions, along with examples of related words and phrases:

#1 Achievement (to praise or reward for an implied accomplishment)

- Congratulations!

- You’re now eligible for a new loan with <brand>

- You’ve earned it

- Congrats

#2 Curiosity

- See your loan options in as little as 5 minutes

- See what you qualify for

- Have a minute?

#3 Fascination

- Mortgages 101

- We’re excited to present our 130-day mortgage rate guarantee

- Introducing . . .

Takeaway: Before rate cuts, language that celebrated the customer’s personal accomplishments and sought to offer value in the way of information (Curiosity and Fascination) performed best.

Top emotions for new loans during the pandemic (after rate cuts)

#1 Gratification

- We’re offering you a fast closing or $2,500 guaranteed

- We offer quick funding

- We’re offering you a lower rate loan in 3 easy steps

- We’re continuing to provide low rates

#2 Intimacy

- Hi <name>

- Hello again

- Come back and check your rates

#3 Attention

- Private message

- Special note

- Attention requested

Takeaway: During periods of rate cuts, lenders may find that winning a customer’s business is more competitive than usual. In turn, words and phrases that are more personal and highlight low rates and tangible value resonate best with consumers.

Top Emotions for refinancing during the pandemic (after rate cuts)

#1 Attention

- Regarding historic low rates

- Please review

- FYI: it’s easy to apply

- We’re trying to reach you about . . .

#2 Fascination

- Here are your repayment options

- Available now

- New refinancing options

- Presenting what refinancing might do for you

#3 Curiosity

- Check the latest interest rates

- Need help?

- Student loan refinancing – see rates & flexible terms

- Want to know what refinancing could do for you?

Takeaway: During rate cuts, content that is informative, contextualizes low rates as a rare opportunity, and provides flexible, easy options to apply, performs best.

Here are three useful tips that sum up best practices for financial services seeking to leverage AI to generate marketing content generation amid a new round of rate cuts:

- Using Attention as your message opener during rate cuts will help you stand out. During this time, customers may be inundated with messaging around rate cuts. This emotion is great for driving immediate engagement—so be sure to follow through with language on tangible value (see below).

- When it comes to marketing new loans during rate cuts, use Gratification to highlight tangible value upfront and provide additional incentives to set yourself apart from other lenders offering the same low rates. Value isn’t just monetary, either. You can speak to added benefits like fast, easy funding.

- When it comes to marketing refinancing opportunities, use Curiosity and Fascination to pique interest and inform customers who may not be aware that rate cuts can mean better rates for the loan they already have. These “gentler” emotions provide value in the way of information.

If you’d like to see how Persado can take your campaign engagement to the next level, contact us here. Until then, happy lending!

*Permutations are changed orders of message elements: Using a numeric example of the set of numbers {1, 2, 3}, the arrangements 123, 321, and 213 are three of the possible permutations of the set. Persado creates and automatically tests permutations for each element of a message variant.

The post Top Tips for Banks to Engage Consumers Amid Fed Rate Cuts appeared first on Persado.