The economy constantly reshapes consumer behavior towards financial services and consumer sentiments around spending. Economic factors have a huge impact on how consumers approach their own finances and think about financial products. While it’s no secret that consumer behaviors are always changing, just how much and how fast they are changing might surprise even the most seasoned marketers.

The Persado Content Intelligence team identified significant changes in the best-performing and worst-performing emotions for customer acquisition campaigns in financial services (i.e. credit cards, loans, mortgages, refinancing, savings accounts, etc.). These eye-opening findings are based on data from real digital marketing campaigns that launched between Q1 2020 and Q1 2023. AI-powered marketing tools continue to reshape how brands connect with and understand their customers. Marketers across industries should take note of these transformative consumer trends in banking and how AI was used to keep digital messaging ahead of the curve.

Let’s dive into changing consumer behavior towards financial services after consumers went from pandemic stimulus checks to record-breaking inflation and how it transformed their responses to digital campaign performance in financial services.

How consumer behavior towards financial services shifted based on real digital marketing campaign data

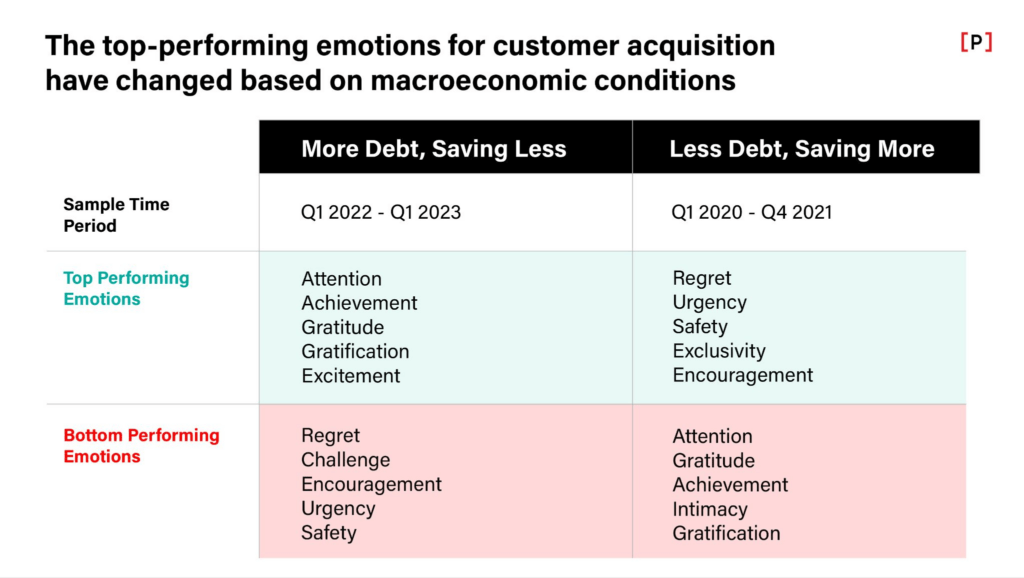

From Q1 2020 to Q4 2021 the average consumer had less debt and saved more due to pandemic stimulus checks, enhanced unemployment benefits, decreases in discretionary spending resulting from pandemic closures, and other factors related to the COVID-19 pandemic. With those macroeconomic factors at play, the top-performing emotions across digital marketing for financial services were REGRET, URGENCY, SAFETY, EXCLUSIVITY, and ENCOURAGEMENT.

These emotions were expressed in financial services campaigns through digital marketing messages like:

- “You’re invited to save for what’s next” [EXCLUSIVITY]

- “Available for a limited time” [URGENCY]

- “Imagine the possibilities” [ENCOURAGEMENT]

The emotions that didn’t perform across digital marketing campaigns in financial services from Q1 2020 to Q4 2021 included ATTENTION, GRATITUDE, ACHIEVEMENT, INTIMACY, and GRATIFICATION.

Financial services companies expressed these emotions using digital marketing messages like:

- “Thank you for banking with us” [GRATITUDE]

- “We want to reward you with a $200 bonus offer” [ACHIEVEMENT]

- “FYI” or “”important message” [ATTENTION]

Then consumer trends in banking changed

Consumers faced supply chain issues, continued inflation, rising interest rates, and economic uncertainty. In this new economic climate, consumers generally found themselves in more debt and saving less money. These changes shifted consumer trends in banking and consumer behavior towards financial services in a very short period of time, visualized in the chart below.

The top-performing emotions and bottom performing emotions for digital marketing in financial services did a complete 180. Starting in Q1 2022, ATTENTION, ACHIEVEMENT, GRATITUDE, GRATIFICATION, and EXCITEMENT became the top-performing emotions in financial services. Not so long before, many of these drove the least amount of consumer engagement across the same digital marketing campaigns. Once the pendulum swung the other way, the highest-performing emotions (and messaging) in digital marketing switched places with the lowest. Emotions like REGRET, URGENCY, and SAFETY that were once winners, began to have the opposite effect on consumers.

The significance of emotions in financial services and customer experience trends in banking

Being a consumer is an emotional experience. Whether it’s the feeling of exclusivity from buying a luxury item or the feeling of gratification after finding the perfect holiday gift, every purchase or action has some type of emotion associated with it.

The words brands use across their digital channels convey emotions. Therefore, they have the potential to make or break a campaign. This is especially true when it comes to consumer behavior towards financial services. Vanguard points out that emotions and investing go hand-in-hand. According to Vox, financial decisions are primarily emotional and people tend to develop some fundamental concepts related to financial behaviors during childhood. Generative AI in financial services isn’t just for promoting loans, account creations, or credit card applications. Many use cases go beyond customer acquisition. AI-generated language can also drive better outcomes for both banks and customers by motivating timely payments.

The psychology of money is real. But, that can always change throughout different stages of life, various aspects of the customer journey, and as economic contexts change. Brands can use AI to stay ahead of consumer behavior trends and deliver campaigns that speak to customers in the moment.

Meet with Persado to discover how our enterprise-grade Generative AI creates personalized digital messaging that motivates customers to engage and act.

The post Exclusive Insights into Consumer Behavior Towards Financial Services appeared first on Persado.