Banking looks different than it did in the past. As more consumers adopt online banking platforms to better suit their increasingly-digital lives, their expectations for financial institutions have also shifted.

Today, consumers are looking for seamless, individualized experiences from the financial companies they work with. But how can companies deliver these experiences to them?

In this webinar, Lessons in AI Language for Credit Card Companies, I sat down with Persado Senior Director of Customer Success Katherine Ollis to talk about about what credit card companies looking to boost loyalty using personalization must know.

Here’s a rundown of what we learned:

Trust in financial institutions has fallen

Consumer financial behavior has changed significantly over the past several years, with 25% of consumers now preferring online banking to in-person services. At the same time, only 29% of consumers trust their primary banks “a lot,” compared to 43% in 2019.

Trust is critical to gaining and retaining customers. However, building up trust can be particularly challenging in the financial sector, as money is often a source of stress, or at the very least a sensitive topic.

Speaking with care can help rebuild that trust

One way credit card companies can build loyalty and gain trust with customers is by speaking to them with care. For example, language that engages and motivates customer action depends on the customer’s financial circumstances.

Using Federal Reserve data, Persado compared the different responses to ad campaigns of consumers with outstanding credit card debt compared to those without it. The analysis showed that customers with high savings balances and low debt responded more to emails using language conveying “Gratitude” than to emails conveying “Encouragement.” The former increased email open rates by 38.2%.

Consumers with low savings and high amounts of debt, in contrast, engaged more with messages that used ”Attention” language: those messages increased open rates by 19.87%.

Providing customers with the emotional language they will engage with can lead to more successful campaigns. This is why having the proper messaging is critical for credit card companies to build trust. With varying financial situations among your customers, a one-size-fits-all approach to messaging will not work.

Adapting to consumer behavior can lead to credit card loyalty

Consumer behavior is constantly changing. Messaging that worked in past campaigns might not work as well in future situations. It is important for companies to adapt to these changes in consumer behavior and preferences to see continued success.

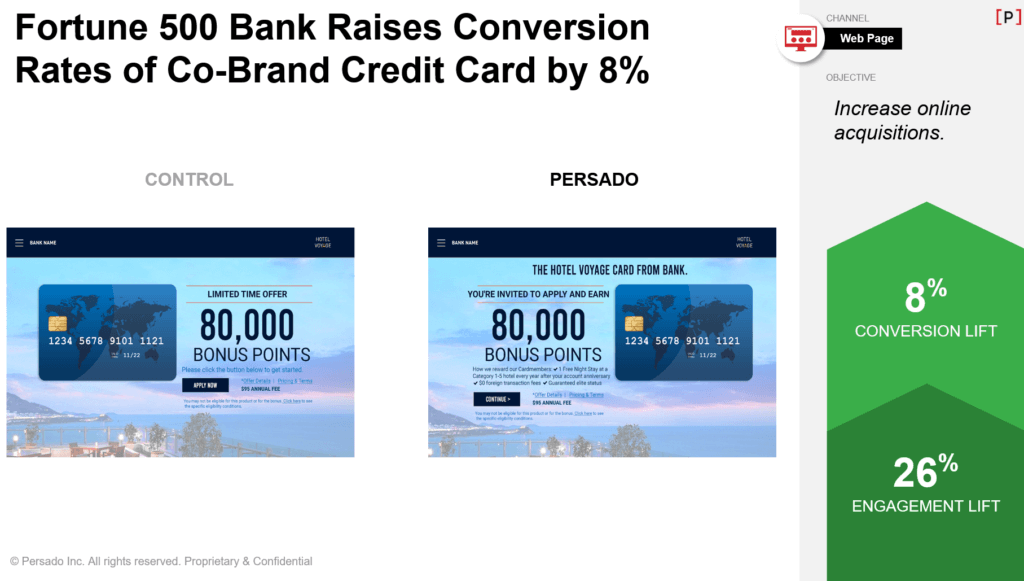

For example, one Fortune 500 company was looking to increase online conversions for a co-branded card acquisition landing page.

Persado generated a collection of variants and ran an experiment to test different elements, from the webpage headline to its CTA. The line “You’re invited to apply and earn” at the top of the webpage contributed to an 8% uplift in conversions, along with a 26% increase in engagement for the Fortune 500 company.

“The [emotional language] makes sure that our customer not just clicks, but really converts and comes with us along this journey,” Ollis says.

Persado brings AI language to credit card companies

With a rapidly-changing, digitally-focused market, credit card companies must rise to the occasion and deliver positive, trust-building customer experiences. Customers must feel like you’re engaging with them on a personal level.

Persado is the only Motivation AI platform enabling personalized communications at scale to inspire individuals to engage and act. Motivation AI is already helping credit card companies drive record levels of acquisitions, on-time payments, and loyalty.

To learn more about how Persado unlocks personalization at scale with first-party data, check out the full webinar: Lessons in AI Language for Credit Card Companies.

The post Generative AI to Improve Credit Card Loyalty appeared first on Persado.