Society is going cashless. While convenient for consumers, that’s caused a drastic decrease in income for tipped workers and this is the problem TackPay addresses. TackPay is a mobile platform that allows users to send, receive and manage tips in a completely digital way, providing tipped workers with a virtual tip jar that makes it easy for them to receive cashless tips directly.

Digitizing the tipping process not only allows individuals to receive tips without cash, but also streamlines a process that has frequently been unfair, inefficient, and opaque, especially in restaurants and hotels. Through TackPay’s algorithm, venues can define the rules of distribution, and automate the tip management process, saving them time. And because tips no longer go through a company’s books but through Tackpay, it simplifies companies’ tax accounting, too.

With a simple, fast and web-based experience accessible by QR code, customers can leave a cashless tip with total flexibility, and transparency.

Technology in TackPay

Without question, our main competitor is cash. From the very beginning, TackPay has worked to make the tipping experience as easy and as fast as giving a cash tip. For this reason, the underlying technology has to deliver the highest level of performance to ensure customer satisfaction and increase their tipping potential.

For example, we need to be able to calibrate the loading of requests in countries at peak times to avoid congesting requests. Offering the page in a few thousandths of a second allows us to avoid a high dropout rate and user frustration. Transactions can also take place in remote locations with little signal, so it is crucial for the business to offer a powerful and accessible service for offline availability options. These are a few of the reasons TackPay chose Google Cloud.

Functional components

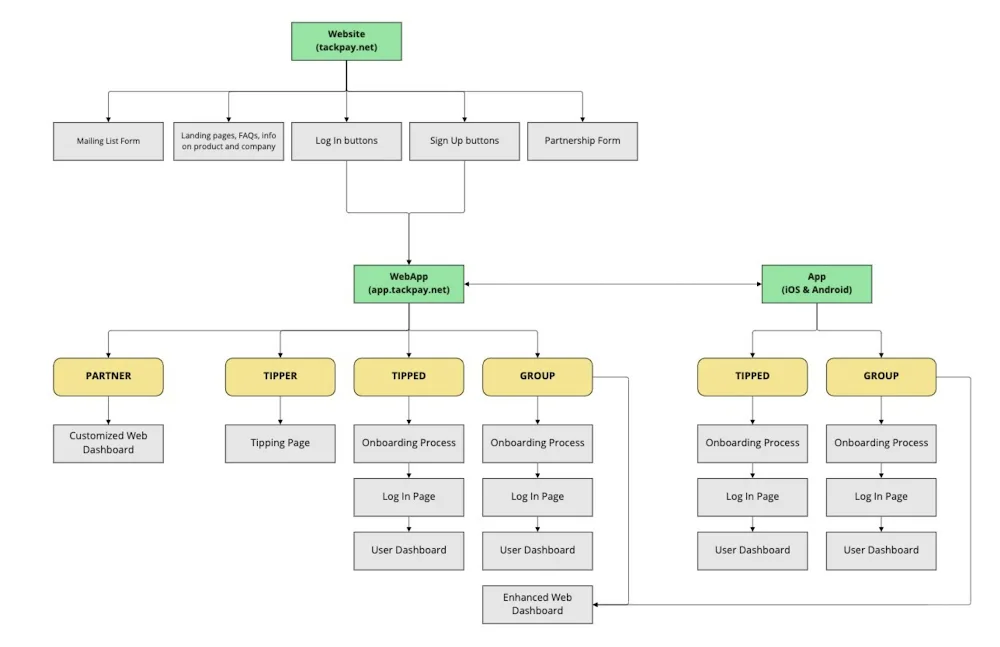

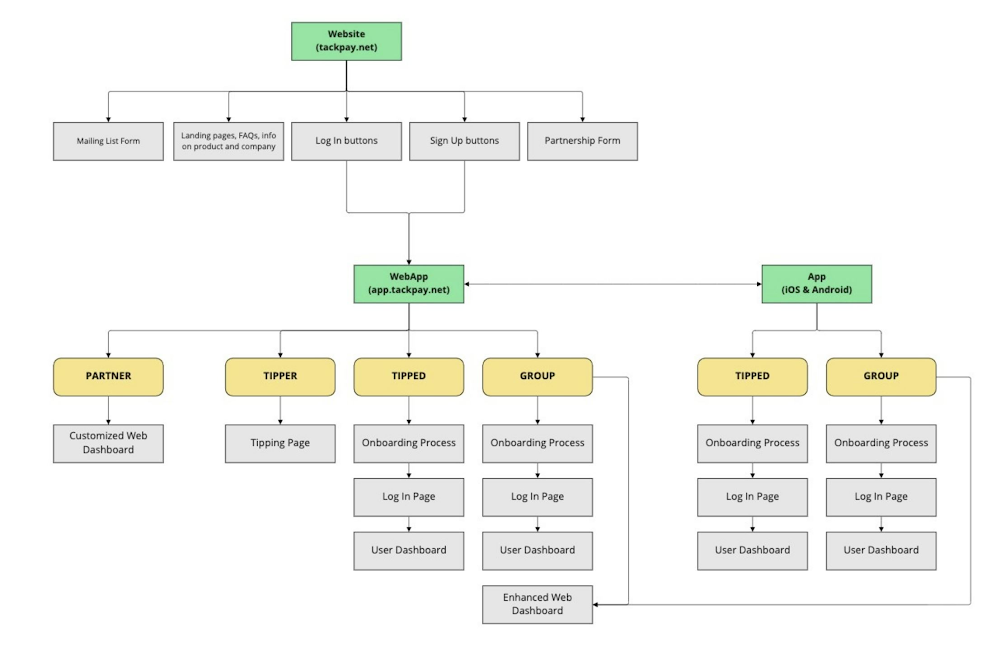

TackPay interfaces include a website, web application and a mobile app. The website is mostly informational, containing sign-up, login and forms for mailing list subscription and partnerships. The web app is the application’s functional interface itself. It has four different user experiences based on the user’s persona: partner, tipper, tipped, and group.

The partner persona has a customized web dashboard.

The tipper sees the tipping page, the application’s core functionality. It is designed to provide a light-weight and low-latency transaction to encourage the tipper to tip more efficiently and frequently.

The tipped, i.e.the receiver, can use the application to onboard into the system, their tip fund, and track their transactions via a dashboard.

The group persona allows the user to combine tips for multiple tip receivers across several services as an entity.

The mobile interface also has similar experience to that of the web for the tipped and group personas. A user dashboard that spans across a few personas covers the feedback, wallet, transactions, network, profile, settings, bank details, withdrawal, docs features for the Tipped persona. In addition to those features, the dashboard also covers the venue details for the Group persona.

Technical architecture to enable cashless tipping

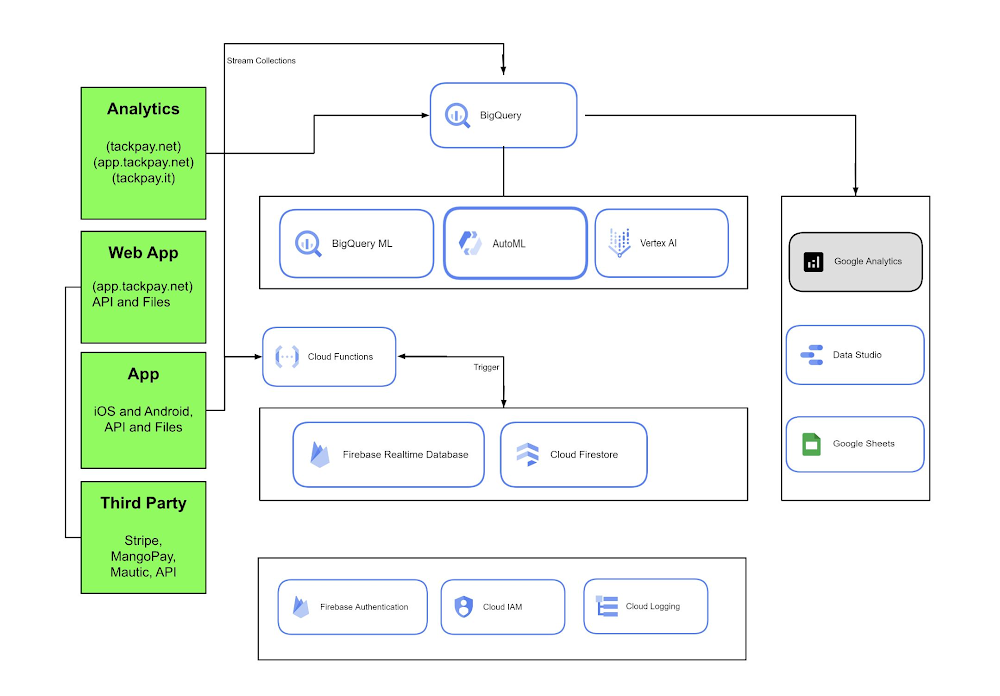

Below is the technical architecture diagram at a high level:

Ingestion

Data comes in from the web application, mobile app, third-party finance application APIs and Google Analytics. The web application and mobile app perform the core business functionality. The website and Google Analytics serve as the entry point for business analytics and marketing data.

Application

The web application and mobile app provide the platform’s core functionality and share the same database — Cloud Firestore.

The tipper persona typically is not required to install the mobile app; they interact with the web application that can be scanned via a QR code and tip for the service. Mobile app is mainly for the tipped and the group categories.

Some important functional triggers are also enabled between the database and application using Google Cloud Functions Gen 2. The application also uses Firebase Authentication, Cloud IAM and Logging.

Database and storage

Firestore collections are used to hold functional data. The collections include payments data for businesses, teams, the tipped, tippers and data for users, partners, feedback, social etc. BigQuery stores and processes all Google Analytics and website data, while Cloud Storage for Firebase stores and serves user data generated from the app.

Analytics and ML

We use BigQuery data for analytics and Vertex AI AutoML for Machine Learning. At this stage, we’re using Data Studio for on-demand, self-serve reporting, analysis, and data mashups across the data sets. The goal is to eventually integrate it with Google Cloud’s Looker in order to bring in the semantic layer and standardize on a single point of data access layer for all analytics in TackPay.

Building towards a future of digital tipping

TackPay product has been online for a few months and is actively processing tips in many countries, including Italy, Hungary, UK, Spain, USA. The solution has been recently installed in leading companies in the hospitality and restaurant industry in Europe, becoming a reliable partner for them. There is an ambitious plan to expand internationally.

To enable this expansion, we’ll need to validate product engagement in specific target countries and scale up by growing the team and the product. Our technical collaboration with Google Cloud will help to make that scaling process effortless. If you are interested about tech considerations for startups, fundamentals of database design with Google Cloud, and other developer / startup topics, check out my blog.

If you want to learn more about how Google Cloud can help your startup, visit our pagehere to get more information about our program, and sign up for our communications to get a look at our community activities, digital events, special offers, and more.